Apple, a paragon of innovation and a titan in the tech industry, stands at a critical crossroad. The fiscal year of 2023 unveiled a stark reality: the company faced its most prolonged revenue downturn in 22 years, with sales dwindling for four straight quarters. This alarming pattern suggests that Apple may be navigating through uncharted waters, raising the pivotal question: Is the tech giant on the cusp of facing significant challenges?

The year 2024 witnessed Apple’s market dynamics oscillate with dramatic intensity. A breathtaking $120 billion vanished from its market valuation in a span of just two days, further exacerbated by a 4.8% nosedive in share prices, cumulatively erasing $160 billion in market capitalization. This tumultuous period reflects investor apprehension amidst global economic uncertainty, looming regulatory confrontations, and speculations of decelerating growth in Apple’s cornerstone product lines. Amid these vicissitudes, Apple’s services segment—comprising Apple Pay, Apple Music, and the App Store—stands as a pillar of growth and resilience. In the fiscal turbulence of 2023, the services sector defied the downward trajectory, notching a 15% surge in revenue, positioning it as a vital counterbalance to the softening in hardware sales and a stabilizing force for Apple’s revenue model.

Stagnation Signals

Apple’s transition into a mature company has brought it under the scrutiny of regulatory bodies and shifted investor perceptions. The U.S. Department of Justice and the European Union’s antitrust actions against Apple, prompted by complaints from companies like Spotify over anti-competitive practices, underscore the legal hurdles Apple faces. Such litigation not only incurs legal costs but also affects investor sentiment and potentially the company’s ability to operate freely in key markets.

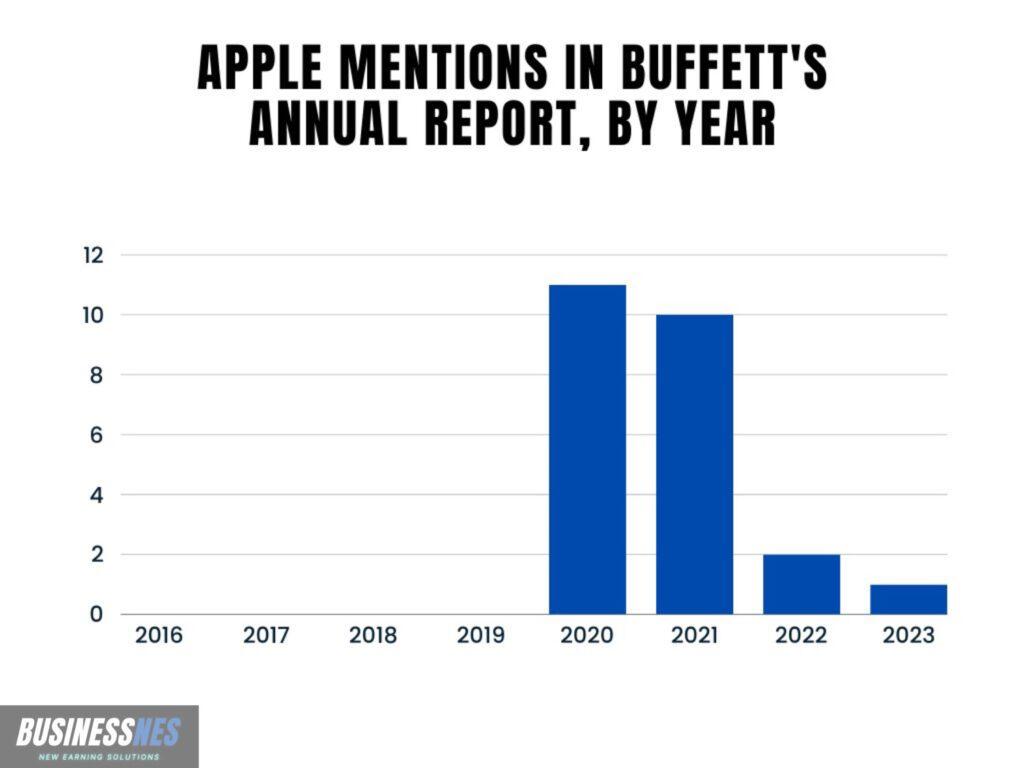

Furthermore, Warren Buffett, a bellwether for many investors, has notably reduced his emphasis on Apple in Berkshire Hathaway’s portfolio discussions, signaling a more cautious stance toward the company. Analysts suggest that concerns over slowing innovation and market saturation for flagship products like the iPhone may be contributing to this shift. Apple’s R&D spending, while substantial at over $20 billion in 2023, has yet to yield a new blockbuster product to reignite rapid growth.

Frequency of Warren Buffett Mentioning Apple in Berkshire Hathaway’s Annual Reports

Further Challenges Ahead

Looking ahead, Apple faces several critical challenges that could impact its stock performance. Disappointing earnings, marked by a fifth consecutive quarter of declining sales, are attributed to weaker-than-expected iPhone sales and supply chain disruptions. These issues have led to downward revisions in revenue forecasts. Specifically, iPhone sales in China—a critical market for Apple—are projected to decline due to increasing competition from local manufacturers who offer high-quality alternatives at more competitive price points.

Additionally, Apple’s innovation pipeline is under intense scrutiny; while the company continues to invest heavily in research and development, there has been a noticeable absence of a new product category with the explosive growth potential of the iPhone or iPad. The anticipation of such innovations remains a significant factor for investor confidence and stock performance. Market analysts highlight the need for breakthroughs in areas like augmented reality, health technology, or automotive solutions to sustain Apple’s growth trajectory in the long term.

Is Something Going Wrong with Apple?

The cancellation of the Apple Car project and the lack of new iPad models in 2023 signify notable departures from Apple’s historical pattern of consistent, innovative product launches. These developments have sparked debates among consumers and investors about Apple’s current innovation cycle and market strategy.

The absence of a new iPad model for the first time the product was launched in 2010 and the shelving of the Apple Car project could reflect deeper issues within Apple’s product development process. The decision to cancel the Apple Car project, reported by Bloomberg in February 2024, not only marks a rare admission of defeat but also raises questions about Apple’s future direction in technology innovation.

The Light in the Tunnel?

Despite facing considerable challenges, Apple finds glimmers of hope in its innovative product lineup and robust services sector. The Apple Vision Pro, although praised for its cutting-edge technology, comes with a steep price tag of $3,499, limiting its mass-market appeal. Yet, it underscores Apple’s dedication to innovation and luxury market targeting. Concurrently, Apple’s services like Apple Pay, Apple Music, and the App Store have demonstrated strong growth, creating a steady revenue stream beyond hardware sales. These services enhance user engagement and open new revenue avenues, critical in offsetting hardware market volatilities.

But can these bright spots sufficiently counterbalance Apple’s broader challenges? The success of its services and high-end products is central to Apple’s strategy, potentially mitigating slower hardware sales and regulatory pressures. This dual strategy of innovation in both products and services might not only help Apple navigate current difficulties but also secure its future growth and industry leadership. The ongoing balance between pioneering technology and expanding services will be pivotal in shaping Apple’s trajectory.

Apple’s Strategy for Resilience and Growth

Facing significant headwinds, Apple showcases its resilience through a strategic mix of innovative products and robust services. The introduction of premium devices like the Apple Vision Pro—its first new product category in nearly a decade—underscores the company’s dedication to leading-edge technology, targeting the luxury market, and upholding its reputation for quality. Additionally, Apple’s plans to roll out generative AI technology signal a potential new revenue stream. However, this raises questions about timing, given that Apple’s AI tools are set to debut almost two years after ChatGPT’s emergence.

As Apple forges ahead, its strategy to balance groundbreaking product introductions with the expansion of its service offerings is pivotal in addressing current market and innovation obstacles. This dual focus is crucial for maintaining Apple’s status as a leader in the technology sector. Success in this endeavor could cement its industry dominance, whereas failure might lead to stagnation and deter investors. The year 2024 looms as a critical juncture for Apple, poised to reveal whether the company will dazzle us with surprises or yield ground to competitors brandishing more disruptive technologies.

Recommended Articles

TOP 40 Fire-Related Business Ideas to Start in 2024

When we think about fire, it's often about its dangers or the essential role it plays in our daily lives, from cooking to keeping us warm. Yet,...

30 Jobs That Will Be Safe in AI & Robot World

In this article, we will explore 30 jobs that will be safe in the AI and robot world. These jobs span a range of industries and sectors, from...

40 Most Popular Types of Restaurants & Eateries

In the following article we have prepared a summary of the most popular, most important and most profitable types of restaurants. Depending on the...

TOP 25 Catering Business Ideas for 2024

If you're looking to start a business in the food industry, exploring catering business ideas for 2024 might be the perfect path for you. The catering world offers a wide range of opportunities, from small, intimate gatherings to large-scale events, allowing for...

30 Types of Clothing Stores – Shop Definitions & Examples

In this article, we have compiled a list of the 30 most common types of clothing stores. At first glance, it might seem that a clothing store is simply a place where clothes are sold, suggesting that there wouldn't be many variations among them. However, the reality...

Most Read

30 Election Season Business Ideas & Opportunities

Election season brings a flurry of activity and opportunities that savvy entrepreneurs can leverage for substantial profits. From the heightened demand for promotional materials to the increased interest in political analysis, the period leading up to elections is...

TOP 20 Best Bakery Types to Open in 2024

In 2024, the bakery industry is set to evolve, blending traditional flavors with innovative concepts to meet the ever-changing tastes of consumers. As we navigate through this delicious transformation, aspiring entrepreneurs are presented with an array of bakery...

Top 30 Prestige Examples & Meaning

Prestige plays a crucial role in shaping social hierarchies and personal perceptions across different cultures and communities. It's the invisible currency that dictates the flow of respect, admiration, and influence among individuals and groups. This article dives...

20 Best Autonomous Consumption Examples

Autonomous consumption represents the level of spending that does not change with variations in income. This article delves into 20 of the most illustrative autonomous consumption examples, shedding light on how certain expenses remain consistent regardless of an...